The success of an LIC is determined by its ability to issue shares at inflated prices. The most successful longrunning listed investment scams are AFI, DJW and MIR. These are run by the same outfit, and have managed to keep their share prices ramped above asset backing for years while issuing shares. AFI, DJW and MIR traded at 24%, 30% and 32% above the value of their actual assets, respectively, in November 2013. These schemes are dependent on net sucker investor inflows and share manipulation.

On the other end of the spectrum, there are failing listed investment companies unable to find more sucker investors, that trade at below NTA since they are not ramped. Criminals that gain control of such entities, often using crossholdings to exercise control not matched by ownership, can freely loot the investment vehicles without ASIC lifting a finger. The criminals need but keep up the flimsiest pretense of propriety, while treating the investing companies as their de facto private property. One such fraud scheme supported by crossholdings is formed by Bentley Capital (BEL.AX), Orion Equities (OEQ.AX) and Queste Communication (QUE.AX). These LICs report total net assets of $40m, fraudulently inflating asset valuations in a variety of ways. QUE owns 54% of OEQ, which owns 28% of BEL.

Having built up extensive crossholdings, the directors can wield control disproportionate to their ownership. BEL/OEQ/QUE is now treated like the private fiefdom of these directors, with assets to dispose of as they wish, making a mockery of the concept of fiduciary duty. Even the Sydney Morning Herald thought the directors took the leeching too far.

http://www.smh.com.au/business/farooq-khan-the-man-behind-the-asxs-worstperforming-listed-investment-company-20130930-2unk8.html

The difference between (the oh so respectable sounding) Bentley Capital and Australian Foundation Investment Company is a matter of degree, not of kind.

Blog outlining massive fraud in the Australian listed investment company (LIC) and broader financial sector

Monday 23 December 2013

Friday 20 December 2013

Magellan Flagship Fund and Merrill Lynch commit securities fraud

Listed investment companies issue and buy back shares, equivalent to how other types of funds issue and redeem units, with the difference that LICs can issue shares priced at above asset backing, yielding great profits for the scheme operators during periods of net investor inflows. The potential for such profits is the main reason for the existence of LICs, with most LICs entirely dependent on such income to remain viable. Over the last decade, hundreds of millions of dollars in hidden profits have been extracted by Australian LIC operators in this way. LICs ramp their share price above NTA, then issue shares at the inflated price, which everyone pretends is an efficient "market" price, no questions asked.

Of course, in an efficient market an LIC would never trade above NTA, but would trade at a discount to its NTA proportional to the LIC's operating costs. Perversely, trading at a premium to assets is trumpeted as a sign of strength by the shills, since this shows a successfully working scam, with these metrics openly marketed on ASX. The October 2013 data cheerfully shows how Australian LICs have outstanding securities with a value exceeding asset backing by more than $3bn. For these funds, marketed to pension savers, $3bn out of $24bn is not backed by any assets, and would not be recoverable if the scheme were to be stopped today, as openly admitted by the criminals themselves.

http://www.asx.com.au/products/managed-funds/market-update.htm

However, this significantly understates the scam, as LICs routinely and fraudulently overstate their assets. Crossholdings within the LIC sector mean actual net tangible assets are lower than reported, as does accounting fraud regarding dividends receivable and derivatives. Moreover, the table only lists institutions that are considered LICs for accounting purposes, whereas the list of de facto listed investment companies on the ASX is much longer.

Magellan Flagship Fund (MFF.AX) is a new strongly growing and fraudulent listed investment company, the share price of which has recently been ramped to 33% above its NTA. An investment of $10,000 dollars in MFF gives the investor a security backed by assets worth $7,500, for an immediate fair value loss of $2,500. There is no reasonable outcome in which this hidden $2,500 fee can be justified, it is a virtual guarantee that the investment will eventually turn out poorly for the average investor. According to MFF's 2013 annual report, the company collected $9.4m in dividends and interest during FY13 from its assets, and had operating expenses of $9.8m, largely paid to management.

http://www.asx.com.au/asxpdf/20130913/pdf/42jc45xb9zp75s.pdf

The annual report uses fraudulent accounting to purposefully obscure the debts of the company. The balance sheet for MFF shows no debt, yet buried in the notes MFF reveals a $120m loan from Merrill Lynch, which MFF ludicrously offsets against cash held with Merrill Lynch "at the balance date". The loan and the cash is in different currencies, making the scheme an undisclosed currency bet. Of course the loan could be used for anything on the days prior to "the balance date", as listed investment companies can sidestep disclosure requirements by temporarily shifting out of assets. Merrill Lynch is assisting MFF with its securities fraud, and is no doubt aware that MFF is a purposefully ramped and underfunded fraud of granny investors.

Of course, in an efficient market an LIC would never trade above NTA, but would trade at a discount to its NTA proportional to the LIC's operating costs. Perversely, trading at a premium to assets is trumpeted as a sign of strength by the shills, since this shows a successfully working scam, with these metrics openly marketed on ASX. The October 2013 data cheerfully shows how Australian LICs have outstanding securities with a value exceeding asset backing by more than $3bn. For these funds, marketed to pension savers, $3bn out of $24bn is not backed by any assets, and would not be recoverable if the scheme were to be stopped today, as openly admitted by the criminals themselves.

http://www.asx.com.au/products/managed-funds/market-update.htm

However, this significantly understates the scam, as LICs routinely and fraudulently overstate their assets. Crossholdings within the LIC sector mean actual net tangible assets are lower than reported, as does accounting fraud regarding dividends receivable and derivatives. Moreover, the table only lists institutions that are considered LICs for accounting purposes, whereas the list of de facto listed investment companies on the ASX is much longer.

Magellan Flagship Fund (MFF.AX) is a new strongly growing and fraudulent listed investment company, the share price of which has recently been ramped to 33% above its NTA. An investment of $10,000 dollars in MFF gives the investor a security backed by assets worth $7,500, for an immediate fair value loss of $2,500. There is no reasonable outcome in which this hidden $2,500 fee can be justified, it is a virtual guarantee that the investment will eventually turn out poorly for the average investor. According to MFF's 2013 annual report, the company collected $9.4m in dividends and interest during FY13 from its assets, and had operating expenses of $9.8m, largely paid to management.

http://www.asx.com.au/asxpdf/20130913/pdf/42jc45xb9zp75s.pdf

The annual report uses fraudulent accounting to purposefully obscure the debts of the company. The balance sheet for MFF shows no debt, yet buried in the notes MFF reveals a $120m loan from Merrill Lynch, which MFF ludicrously offsets against cash held with Merrill Lynch "at the balance date". The loan and the cash is in different currencies, making the scheme an undisclosed currency bet. Of course the loan could be used for anything on the days prior to "the balance date", as listed investment companies can sidestep disclosure requirements by temporarily shifting out of assets. Merrill Lynch is assisting MFF with its securities fraud, and is no doubt aware that MFF is a purposefully ramped and underfunded fraud of granny investors.

Monday 9 December 2013

Innopac, IPCO and Blumont Group commit securities fraud

Australia is not the sole domain of listed investment company fraud and regulator complicity. In Singapore, a group of listed investment companies has formed a giant securities fraud cartel. Innopac (I26.SI), Blumont Group (A33.SI), IPCO (I11.SI), LionGold (A78.SI) and Asiasons (5ET.SI) engage in revaluation fraud and circular investment schemes. The cartel builds massive crossholdings, engages in fraudulent related party transactions, falsifies NTAs, and manipulates stock prices. After ramping its shares, Innopac made a bid for ASX-listed Merlin Diamonds (MED.AX), as this blog mentioned in April 2013.

Innopac and its accomplices deliberately ramped its share price far beyond asset backing. It is during such a ramp that granny investor money is stolen, not during the inevitable crash to fair value. In October 2013 the share prices of the Singapore listed investment scams collapsed, perhaps because they had been warned by the complicit regulator that their scam was getting embarrassingly obvious.

Just like its Australian counterparts, Singaporean regulators have made no attempt to prosecute the criminals, preferring to pretend the share ramps were inexplicable magical market mysteries instead of fraud. Singaporean regulators have de facto become accomplices to the criminals, covering their tracks and protecting them. Just like in Australia, there is no free press to expose the criminals. In both Singapore and Australia, the rich and powerful criminal operators of listed investment scams have subverted the system to the point where a small investor has zero recourse to the law. Now the first lawsuits from the scam have started arriving in Singapore and Britain.

In Australia, Blumont Group has stakes in Cokal (CKA.AX) and Celsius Coal (CLA.AX), and is being sued for reneging on an investment in Prospect Resources (PSC.AX).

To be entirely clear and specific here: Innopac, Blumont, IPCO, LionGold and Asiasons are criminal organizations, vehicles of securities fraud run by criminals that consider themselves above the law. Singaporean regulators are complicit morons and are protecting the criminals. The ramps were not magical market mysteries, they were fraud. Any investor that lost money due to the regulator's astounding incompetence and complicity can expect zero justice. But in the extremely unlikely scenario that the criminals one day face justice, the regulator accomplices should be lined up right next to them.

Saturday 7 December 2013

Aha! Avestra and the "Formosa Auto Trade" scam

From humble origins, Avestra has recently stepped up to the big leagues of financial crime, having acquired and ramped listed funds manager AG Financial (AHA.AX), gaining control over its funds. Only three short years ago, Avestra was involved with the "Formosa Auto Trade" scam, handing out flyers selling magical laptops with auto-trading software. For only $15,950, you could buy the Formosa Premium One package, yielding $1,000 a month in profits, "no knowledge or effort required". But wait! For only $22,550, you could buy the Premium Plus package and take home $2,000 a month. However, the best deal of all was obviously the Turbo package, costing you only $29,700 upfront and yielding $5,000 a month.

The "Formosa Auto Trade" scam was advertised by Signal Systems and Support using the AFSL of Bold Capital, which was the authorised representative of Avestra Capital. The fraudsters spammed these flyers on stock discussion boards, complete with phony testimonials, receiving a fair share of heckling for their childishly transparent scam.

http://www.aussiestockforums.com/forums/showthread.php?t=21337

http://www.forexpeacearmy.com/forex-forum/scam-alerts-folder/13119-formosa-auto-trade-system-paycheck-autotrade-scam.html

ASIC does nothing about securities fraud because it is an absolute joke. ASIC legitimizes and enables career criminals that have been involved in scams going back decades.

http://www.smh.com.au/articles/2002/07/19/1026898914951.html

With ASIC's support and help, what was once a petty $30K-a-pop fraud has now grown into an ASX-listed fraud controlling dozens of millions of misappropriated granny investor funds. The walking bags of fecal matter at ASIC must be truly proud of their achievement here.

The "Formosa Auto Trade" scam was advertised by Signal Systems and Support using the AFSL of Bold Capital, which was the authorised representative of Avestra Capital. The fraudsters spammed these flyers on stock discussion boards, complete with phony testimonials, receiving a fair share of heckling for their childishly transparent scam.

http://www.aussiestockforums.com/forums/showthread.php?t=21337

http://www.forexpeacearmy.com/forex-forum/scam-alerts-folder/13119-formosa-auto-trade-system-paycheck-autotrade-scam.html

ASIC does nothing about securities fraud because it is an absolute joke. ASIC legitimizes and enables career criminals that have been involved in scams going back decades.

http://www.smh.com.au/articles/2002/07/19/1026898914951.html

With ASIC's support and help, what was once a petty $30K-a-pop fraud has now grown into an ASX-listed fraud controlling dozens of millions of misappropriated granny investor funds. The walking bags of fecal matter at ASIC must be truly proud of their achievement here.

Friday 6 December 2013

Avestra Asset Management launches new circular investment fraud

ASIC has for years done absolutely nothing to stop circular investment scams where associated funds "invest" in each other instead of investing in actual assets. As a result, such securities fraud is now endemic in the Australian funds industry, with new scams emerging daily. Avestra Asset Management recently launched yet another scam of this type. Avestra runs the managed funds Avestra Advantage, Canton Mackenzie and Worberg Global. Using money entrusted to these funds by gullible investors, Avestra took over listed funds manager Excela (EXA.AX), now renamed AG Financial (AHA.AX). After gaining control, Avestra had the managed funds Excela Maximiser and Emergent "invest" in Avestra Advantage and Worberg Global. This is blatant securities fraud, and would have led to arrests in other countries.

http://fundhost.com.au/investor/maximiser

http://fundhost.com.au/investor/emergent

Avestra Advantage and Worberg Global were issued AHA shares at $0.02. Avestra then ramped AHA to $0.04 in late June 2013 on no volume, artificially inflating the NTA of its funds. As a result of this revaluation fraud all Avestra funds now have fraudulent NTAs.

On semi-functional websites that look like they were designed by someone paid five dollars, perhaps a freelancer, Avestra funds claim to offer high returns, low volatility and capital growth. The claims of low volatility seem strange, given that Canton Mackenzie's NAV fell 16% in the single month of February 2013, as did Avestra Advantage. These funds have extremely suspicious returns. Worberg Global was ramped up around 50% in August 2012, while Avestra Advantage was ramped 28% in the same month.

http://www.worberg.com/newfund2/

http://www.avestra-advantage-fund.com/performance.php

http://www.cantonmackenzie.com/performance/

The funds have entirely fraudulent returns as they are circular investment scams. As long has Avestra has net investor inflows, its funds can claim any monthly return they want to. If Avestra's investors were to try and cash out, however, the inflated prices could not be maintained by the criminals, that reportedly have extensive experience in shady business deals and gender-bending.

http://www.smh.com.au/business/genderbender-of-a-tale-with-a-uranium-chaser-20090924-g4rs.html

Avestra only had to spend a few million dollars of other people's money to gain control over Excela's $22m in managed funds and plunder them. Excela's previous management sold its granny investors for a confidential amount to Avestra, according to page seven of its annual report.

http://www.asx.com.au/asxpdf/20131025/pdf/42kb3dbrl2t08c.pdf

ASIC will allow this fraud to continue until it blows up, at which point it will deny any responsibility. ASIC goes beyond incompetency here.

http://fundhost.com.au/investor/maximiser

http://fundhost.com.au/investor/emergent

Avestra Advantage and Worberg Global were issued AHA shares at $0.02. Avestra then ramped AHA to $0.04 in late June 2013 on no volume, artificially inflating the NTA of its funds. As a result of this revaluation fraud all Avestra funds now have fraudulent NTAs.

On semi-functional websites that look like they were designed by someone paid five dollars, perhaps a freelancer, Avestra funds claim to offer high returns, low volatility and capital growth. The claims of low volatility seem strange, given that Canton Mackenzie's NAV fell 16% in the single month of February 2013, as did Avestra Advantage. These funds have extremely suspicious returns. Worberg Global was ramped up around 50% in August 2012, while Avestra Advantage was ramped 28% in the same month.

http://www.worberg.com/newfund2/

http://www.avestra-advantage-fund.com/performance.php

http://www.cantonmackenzie.com/performance/

The funds have entirely fraudulent returns as they are circular investment scams. As long has Avestra has net investor inflows, its funds can claim any monthly return they want to. If Avestra's investors were to try and cash out, however, the inflated prices could not be maintained by the criminals, that reportedly have extensive experience in shady business deals and gender-bending.

http://www.smh.com.au/business/genderbender-of-a-tale-with-a-uranium-chaser-20090924-g4rs.html

Avestra only had to spend a few million dollars of other people's money to gain control over Excela's $22m in managed funds and plunder them. Excela's previous management sold its granny investors for a confidential amount to Avestra, according to page seven of its annual report.

http://www.asx.com.au/asxpdf/20131025/pdf/42kb3dbrl2t08c.pdf

ASIC will allow this fraud to continue until it blows up, at which point it will deny any responsibility. ASIC goes beyond incompetency here.

Thursday 5 December 2013

Clime Capital (CAM.AX) reveals hidden crossholding fraud

Clime Investment Management (CIW.AX) manages Clime Capital (CAM.AX) as well as wholesale funds. CIW owns 7.82% of CAM, which is associated with WAM, which owns 20.82% of CIW. CAM is a listed investment scam paying dividends out of capital raisings, as management fees swallow most cash generated from assets, with the fair value of CAM but a fraction of its asset backing. The Clime fund empire is a circular investment scam, similar to that of van Eyk and Aurora.

CIW manages several listed and unlisted funds. Instead of purchasing actual assets with the money it was entrusted, CIW created internal crossholdings between its funds, and failed to disclose these holdings in substantial shareholder notices or related party disclosures. This is securities fraud. On 5 December 2013 CIW suddenly revealed a previously undisclosed stake in CAM held through its wholesale funds, bringing total ownership to 19.20% instead of the previously disclosed 7.82%.

http://www.asx.com.au/asxpdf/20131205/pdf/42lfgj1qngr3sz.pdf

In a country where the regulator was doing its job instead of bleating its magnificence, this fund scam would have led to arrests and fraud charges. CIW openly breached its fiduciary duty by diverting funds into crossholdings, doubledipping on fees and deliberately inflating its NTA. CIW purposefully moved investor money into crossholdings that have zero net value for investors but increase fees for CIW. The CIW funds that hold CAM are fraudulently overstating their NTAs at this moment. This is fraud, without any question.

CIW went so far as to deliberately try to hide its fraud in annual reports and other disclosure, yet still ASIC refuses to do anything. CIW still has not disclosed exactly when it started its internal crossholding fund fraud, nor at what price, nor how much unrealized profits and fees have been generated by the scam.

CIW manages several listed and unlisted funds. Instead of purchasing actual assets with the money it was entrusted, CIW created internal crossholdings between its funds, and failed to disclose these holdings in substantial shareholder notices or related party disclosures. This is securities fraud. On 5 December 2013 CIW suddenly revealed a previously undisclosed stake in CAM held through its wholesale funds, bringing total ownership to 19.20% instead of the previously disclosed 7.82%.

http://www.asx.com.au/asxpdf/20131205/pdf/42lfgj1qngr3sz.pdf

In a country where the regulator was doing its job instead of bleating its magnificence, this fund scam would have led to arrests and fraud charges. CIW openly breached its fiduciary duty by diverting funds into crossholdings, doubledipping on fees and deliberately inflating its NTA. CIW purposefully moved investor money into crossholdings that have zero net value for investors but increase fees for CIW. The CIW funds that hold CAM are fraudulently overstating their NTAs at this moment. This is fraud, without any question.

CIW went so far as to deliberately try to hide its fraud in annual reports and other disclosure, yet still ASIC refuses to do anything. CIW still has not disclosed exactly when it started its internal crossholding fund fraud, nor at what price, nor how much unrealized profits and fees have been generated by the scam.

Biotech Capital (BTC.AX) loses 56% of its imaginary assets

Biotech Capital (BTC.AX) is yet another listed investment scam with book assets valued entirely according to the "opinions" of the operators. In its 30 October net tangible asset disclosure, BTC fraudulently claimed an NTA of $0.0416 based on director opinions, despite its auditor refusing to sign off on this entirely imaginary valuation in the annual report. In the November 30 NTA disclosure, BTC then announced a 56% downward revaluation of NTA to $0.0181, with its only remaining investment slashed to a third of its previously carried value. Any investor that based a purchasing decision on what was a blatantly fraudulent October NTA disclosure is simply out of luck, and shouldn't have expected such petty details as fund asset disclosures to be regulated in any way by ASIC. BTC currently has a "market" price of $0.025, according to ASIC due to an entirely inexplicable magical market mystery.

http://www.asx.com.au/asxpdf/20131101/pdf/42kl1k9ylcvqt0.pdf

http://www.asx.com.au/asxpdf/20131203/pdf/42lbxjtkmscc05.pdf

BTC now has book assets of $1.4m, with incumbent management extracting around $0.4m a year in cash from the remains of the failed company, obscured through deceptive accounting. The directors extract this $400K because they have control and can do so. BTC claims to be in wind-down and would thus appear to be approaching the end of the line. However, it is a very safe bet to assume the criminal operators of this scheme will miraculously find a great new opportunity for issuing shares to granny investors instead of closing up shop.

Just as BTC carried its investment in unlisted Sensear at a deliberately inflated value, so fund managers continue to carry BTC at values they well know are inflated. This is securities fraud, with inflated assets laundered through a chain of holdings. Select Asset Management currently holds 23% of BTC through a melange of funds, and carries its stake at an inflated "market" price, despite being well aware it could not actually sell its holding at that price.

In October, Select Asset Management claimed to have sold 3.5m shares of BTC for $734,469, for a sale price of $0.209, ten times the price that BTC traded on the ASX.

http://www.asx.com.au/asxpdf/20131022/pdf/42k6tqxmpc0dqj.pdf

This is either a typo that no one noticed because ASX disclosures are in effect unregulated, or another magical market mystery.

http://www.asx.com.au/asxpdf/20131101/pdf/42kl1k9ylcvqt0.pdf

http://www.asx.com.au/asxpdf/20131203/pdf/42lbxjtkmscc05.pdf

BTC now has book assets of $1.4m, with incumbent management extracting around $0.4m a year in cash from the remains of the failed company, obscured through deceptive accounting. The directors extract this $400K because they have control and can do so. BTC claims to be in wind-down and would thus appear to be approaching the end of the line. However, it is a very safe bet to assume the criminal operators of this scheme will miraculously find a great new opportunity for issuing shares to granny investors instead of closing up shop.

Just as BTC carried its investment in unlisted Sensear at a deliberately inflated value, so fund managers continue to carry BTC at values they well know are inflated. This is securities fraud, with inflated assets laundered through a chain of holdings. Select Asset Management currently holds 23% of BTC through a melange of funds, and carries its stake at an inflated "market" price, despite being well aware it could not actually sell its holding at that price.

In October, Select Asset Management claimed to have sold 3.5m shares of BTC for $734,469, for a sale price of $0.209, ten times the price that BTC traded on the ASX.

http://www.asx.com.au/asxpdf/20131022/pdf/42k6tqxmpc0dqj.pdf

This is either a typo that no one noticed because ASX disclosures are in effect unregulated, or another magical market mystery.

Monday 2 December 2013

Australia China Holdings (AAK.AX) and its pear fund friends

Bermuda incorporated Australia China Holdings (AAK.AX) is yet another ASX-listed investment company featuring crossholdings and related party transactions, with several of its subsidiaries showing up as top twenty shareholders of the company. AAK claims operations in "trading, property investment, hotel management and other projects in environmental businesses", and has 3.5bn shares outstanding, the result of decades of share issues and ramps. These shares currently trade at a "market" price between $0.001-0.002, giving AAK a market cap up to $7m.

AAK offers Australian investors an opportunity usually only available from Nigerian princes. According to its latest annual report, AAK has assets of $73m in the form of a deposit paid on Mongolian farmland. Now AAK shareholders just need to pay another $1m in "registration fees", and they will own farmland worth $73m! (AAK's Malaysian auditor carefully qualified its opinion as to the "recoverability of the deposits", AAK's only asset.) This invaluable farmland has so far provided zero actual cash flow for AAK, despite AAK apparently having leased the farmland to the ungoogleable "Beijing Shuimu Zhongtian Institute of Horticulture Sciences" for $2m a year in 2011. In fact, AAK mysteriously had no operating cash inflows at all for the last five years.

http://www.asx.com.au/asxpdf/20130626/pdf/42gphzykt8dz7l.pdf

That's OK though, because operating cash flows are not necessary for securities fraud. AAK has an ASX-listing and sports a "market" value endorsed by ASIC, and this in and of itself gives AAK utility for revaluation fraud. In December AAK announced it has forged a strategic agreement with an unnamed Chinese investment group with strong backing from "pear fund managers" (sic), to issue more shares.

http://www.asx.com.au/asxpdf/20131202/pdf/42l9x9vzm72c3x.pdf

The unnamed investment group and AAK will obtain financing, invest in each other, and place shares together. The related party is about to start again, with ASIC proudly chaperoning.

AAK offers Australian investors an opportunity usually only available from Nigerian princes. According to its latest annual report, AAK has assets of $73m in the form of a deposit paid on Mongolian farmland. Now AAK shareholders just need to pay another $1m in "registration fees", and they will own farmland worth $73m! (AAK's Malaysian auditor carefully qualified its opinion as to the "recoverability of the deposits", AAK's only asset.) This invaluable farmland has so far provided zero actual cash flow for AAK, despite AAK apparently having leased the farmland to the ungoogleable "Beijing Shuimu Zhongtian Institute of Horticulture Sciences" for $2m a year in 2011. In fact, AAK mysteriously had no operating cash inflows at all for the last five years.

http://www.asx.com.au/asxpdf/20130626/pdf/42gphzykt8dz7l.pdf

That's OK though, because operating cash flows are not necessary for securities fraud. AAK has an ASX-listing and sports a "market" value endorsed by ASIC, and this in and of itself gives AAK utility for revaluation fraud. In December AAK announced it has forged a strategic agreement with an unnamed Chinese investment group with strong backing from "pear fund managers" (sic), to issue more shares.

http://www.asx.com.au/asxpdf/20131202/pdf/42l9x9vzm72c3x.pdf

The unnamed investment group and AAK will obtain financing, invest in each other, and place shares together. The related party is about to start again, with ASIC proudly chaperoning.

Thursday 28 November 2013

The canker: new revaluation frauds launched

If corruption and crime is allowed to fester unchecked, by its very nature it will spread. For years ASIC has allowed revaluation fraud and share ramping in the Australian market. As a result, new investment companies engaging in revaluation fraud are now sprouting like mushrooms on the ASX, with every failed and chronically loss-making entity imaginable starting anew as an LIC. After all, it is much easier to manufacture imaginary unrealized profit than it is to generate real cash profit. The new investment companies all follow the same modus operandi; they buy (often related party) assets, revalue these upward, ramp the investment company share price, and then issue shares to granny investors based on its great new "assets" and "profits".

Australasian Wealth Investments (AWK.AX) is a new listed investment scam created from the shell of MEF.AX, which in turn sprung from FAT.AX. During its phoenixing, it performed a series of sham transactions between related parties, and acquired a 50% stake in unlisted van Eyk research, which it can now revalue at will. AWK's most recently reported net tangible asset backing was $0.3753. AWK is issuing 38m shares at $0.3705, increasing shares outstanding by two thirds. AWK's share price was then ramped to $0.495 by the scheme's operators and accomplices, allowing them to book unrealized profits in excess of 30% in a matter of weeks.

Ramping AWK to $0.495 allows Contango Asset Management (CTN.AX) and Leyland Asset Management to fraudulently book unrealized profits in excess of 30% on their holdings of AWK. CTN pays real cash fees to its management based on such fraudulent unrealized "profits", and issues CTN shares to granny investors based on books with inflated assets. Of course, according to ASIC, when a revaluation fraud ramp occurs, it is not a ramp at all, but rather a magical market mystery.

Allied Consolidated (ABQ.AX) is another new revaluation fraud. Recently called Allied Brands, perennially loss-making ABQ is now changing name again, to Disruptive Investment Group, like children painting stripes on a car to make it go faster. ABQ has bought a failed internet business for $35,000, which it can revalue at will. At its general meeting ABQ resolved to issue 120,000,000 shares at $0.0025, issue 190,000,000 shares at $0.01, issue 60,000,000 options at $0.000025, and issue 20,000,000 shares to previous noteholders, with sundry allotments to directors. ABQ's price was then ramped to trade around $0.03.

Australasian Wealth Investments (AWK.AX) is a new listed investment scam created from the shell of MEF.AX, which in turn sprung from FAT.AX. During its phoenixing, it performed a series of sham transactions between related parties, and acquired a 50% stake in unlisted van Eyk research, which it can now revalue at will. AWK's most recently reported net tangible asset backing was $0.3753. AWK is issuing 38m shares at $0.3705, increasing shares outstanding by two thirds. AWK's share price was then ramped to $0.495 by the scheme's operators and accomplices, allowing them to book unrealized profits in excess of 30% in a matter of weeks.

Allied Consolidated (ABQ.AX) is another new revaluation fraud. Recently called Allied Brands, perennially loss-making ABQ is now changing name again, to Disruptive Investment Group, like children painting stripes on a car to make it go faster. ABQ has bought a failed internet business for $35,000, which it can revalue at will. At its general meeting ABQ resolved to issue 120,000,000 shares at $0.0025, issue 190,000,000 shares at $0.01, issue 60,000,000 options at $0.000025, and issue 20,000,000 shares to previous noteholders, with sundry allotments to directors. ABQ's price was then ramped to trade around $0.03.

The shenanigans at ABQ was too much even for the auditor to unflinchingly stomach, with the auditor making a "disclaimer of auditor's opinion" in the 2013 annual report and refusing to sign off that ABQ is compliant with the Corporations Act.

Meanwhile, ASIC is giving its guarantee that ABQ is not ramped and manipulated, just like it does for every single revaluation fraud. For if ABQ were ramped and manipulated, ASIC would have to do something about it.

Wednesday 27 November 2013

A scam is but an investment with comprehensive management fees

US Masters Residential Property Fund (URF.AX) is a scam run by Dixon Advisory. The fund claims to invest in high-yielding American property, purportedly using collected rental income to pay steady high dividends to granny investors. In reality, URF is a ponzi that pays its dividends out of capital raisings. The operators of this scheme manipulate URF's share price while gutting the fund with various hidden fees and related party transactions. URF's half-year report for the six months to June 2013 brazenly describes ongoing securities fraud.

http://www.asx.com.au/asxpdf/20130828/pdf/42hzwfpnj35qh0.pdf

In the six months to June 2013, URF had investment property rental income of $4.4m, with rental expenses of $2.5m, for net rental income of $1.9m. From this $1.9m income, the scheme operators charged fees exceeding $10m:

These are but a subset of the fees charged by Dixon and related parties. Of these $10.4m in fees, only $1.7m was recognized as management fees in the profit & loss statement, with the rest obscured by fraudulent accounting and deceptively hidden in report footnotes. URF also paid out distributions to unitholders totalling $10.4m. All this was made possible by issuing shares worth $74m. What has just been described is not a viable business plan, it is a ponzi.

If URF shares were to trade freely they would have collapsed in value. Instead, Dixon and accomplices completely control URF's share price, and have ramped the price above reported NTA. URF does not trade at a "market" price, its price is fixed by the scheme operators. ASIC refuses to take any action, instead protecting the criminals. According to ASIC, the URF ramp is a magical market mystery, and not fraud. Dixon would never have been able to commit its crimes if not for the facilitation and legitimization from ASIC, its most valuable partner.

On 28 August 2013 a partner at Deloitte signed off on URF's half-year report, thereby becoming an accomplice to Dixon's securities fraud. From the accounts the auditor would have been perfectly aware of the fraudulence of the scheme, or should have been in any case, yet the scum still signed off on it. The partner did this safe in the knowledge he will never face prosecution for his role in this scam, never have to face any consequences for his crime.

http://www.asx.com.au/asxpdf/20130828/pdf/42hzwfpnj35qh0.pdf

In the six months to June 2013, URF had investment property rental income of $4.4m, with rental expenses of $2.5m, for net rental income of $1.9m. From this $1.9m income, the scheme operators charged fees exceeding $10m:

- Dixon is entitled to an annual Responsible Entity Fee of 0.55% of the fund's gross asset value, charging $460,958 in HY13.

- Dixon is entitled to an annual Investment Management Fee of 2% of the fund's gross asset value, charging $1,057,751 in HY13.

- Dixon is entitled to a Leasing Fee of 3 months gross rent on new leases, charging $499,987 in HY13.

- Dixon is entitled to an Asset Acquisition Fee of 1.99% of the purchase price of assets acquired, charging $1,816,728 in HY13.

- Dixon is entitled to a Structuring and Handling Fee of 2% of total funds raised, charging $2,947,774 in HY13.

- Dixon is entitled to a Debt Arranging Fee of 2% of the gross amount of borrowings obtained, charging $614,872 in HY13.

- Dixon is entitled to on-charge "administrative expenses", charging $3,042,028 in HY13.

These are but a subset of the fees charged by Dixon and related parties. Of these $10.4m in fees, only $1.7m was recognized as management fees in the profit & loss statement, with the rest obscured by fraudulent accounting and deceptively hidden in report footnotes. URF also paid out distributions to unitholders totalling $10.4m. All this was made possible by issuing shares worth $74m. What has just been described is not a viable business plan, it is a ponzi.

If URF shares were to trade freely they would have collapsed in value. Instead, Dixon and accomplices completely control URF's share price, and have ramped the price above reported NTA. URF does not trade at a "market" price, its price is fixed by the scheme operators. ASIC refuses to take any action, instead protecting the criminals. According to ASIC, the URF ramp is a magical market mystery, and not fraud. Dixon would never have been able to commit its crimes if not for the facilitation and legitimization from ASIC, its most valuable partner.

On 28 August 2013 a partner at Deloitte signed off on URF's half-year report, thereby becoming an accomplice to Dixon's securities fraud. From the accounts the auditor would have been perfectly aware of the fraudulence of the scheme, or should have been in any case, yet the scum still signed off on it. The partner did this safe in the knowledge he will never face prosecution for his role in this scam, never have to face any consequences for his crime.

Monday 25 November 2013

Big fish eat little fish

The fair value of a listed investment company as a going concern is always lower than its liquidation value, since ongoing management costs burn a proportion of the cash generated by assets. This means that smaller LICs are vulnerable to predation by bigger LICs, by nature, if they allow their shares to trade at fair value. To avoid predation, LICs ramp their "market" prices above fair value, form crossholdings with accomplices, and entrench various poison pill measures designed to make it costly or impossible to wrench incumbent management away from the fee frenzy. Shrinking funds are especially susceptible to change of control, with the aggressor LIC not interested in the target's assets, but looking to take over the target's granny investors. A sharemarket listing provides legitimacy, allows the charade of a "market" price, and crucially, allows the investment company to issue inflated shares to granny investors.

The latest "new" Australian listed investment scam and revaluation fraud is Thorney Opportunities (TOP.AX), formerly Wentworth Holdings (WWM.AX), due to issue millions of shares at a purposefully inflated price. Thorney has ensconced its position with an openly exploitative management agreement that gives it 1.5% of gross assets annually and 20% of any increase in net asset value. The "independent expert" hired by Thorney calculated that the takeover would immediately destroy a quarter of shareholder value for non-associates ($0.525 before versus $0.409 after takeover). The "expert" then astoundingly concluded this was "not fair but reasonable", which seems like a perplexing conclusion, until you remember this is what the expert was paid to do.

The latest "new" Australian listed investment scam and revaluation fraud is Thorney Opportunities (TOP.AX), formerly Wentworth Holdings (WWM.AX), due to issue millions of shares at a purposefully inflated price. Thorney has ensconced its position with an openly exploitative management agreement that gives it 1.5% of gross assets annually and 20% of any increase in net asset value. The "independent expert" hired by Thorney calculated that the takeover would immediately destroy a quarter of shareholder value for non-associates ($0.525 before versus $0.409 after takeover). The "expert" then astoundingly concluded this was "not fair but reasonable", which seems like a perplexing conclusion, until you remember this is what the expert was paid to do.

Thorney and its criminal associates currently control the share price of WWM. WWM had an October 2013 net asset backing of $0.45, and is issuing millions of shares at $0.50, yet its current share price mysteriously has shot up to $0.68, in what ASIC guarantees to be a normal market movement and not a deliberate ramp. The true reason is not magic, however, it is fraud. The reason that WWM now trades at 50% above its latest reported NTA is that it has become a vehicle for securities fraud, with a completely manipulated "market" price.

Thursday 21 November 2013

van Eyk funds "invest" in each other

van Eyk funds are engaged in revaluation fraud, using crossholdings and circular trading to artificially inflate assets. Listed van Eyk Blueprint Alternatives Plus (VBP.AX) feeds money into unlisted van Eyk funds that it can revalue at will. Various van Eyk funds then divert funds back into VBP. VBP is a circular investment scheme, a ponzi that pays dividends depending on how many units it can issue. In countries governed by the rule of law, VBP's circular investment scheme would already have led to fraud charges. ASIC has flatly refused to take any action whatsoever. van Eyk's fund empire deliberately overstates its assets by millions of dollars using internal crossholdings, by having its listed and unlisted funds fraudulently "invest" in each other.

According to its 2013 cash flow statement, VBP received $2.6m in dividends and interest from its related party "assets", with entirely reasonable and sustainable management expenses of $5.6m. VBP then paid $16m in distributions, made possible by $19m net inflows from unitholder applications.

http://www.asx.com.au/asxpdf/20130930/pdf/42jqdtc9kmrnw7.pdf

According to its annual report, VBP had total assets of $275m in 2013, $68m of which mysteriously consisted of receivables from brokers for securities sold, with $168m in the unlisted van Eyk Blueprint Alternatives Plus fund. These "assets" conspicuously fail to generate cashflows, which does not deter "investors" from buying VBP. The top 20 shareholders of VBP include funds such as van Eyk Blueprint Balance, van Eyk Blueprint High Growth and van Eyk Blueprint Capital Stable. This is open fraud, only possible because of ASIC's ongoing gross negligence and incompetence.

Aurora funds management is the responsible entity for VBP, acting as van Eyk's accomplice in this circular investment scam, but has lately started to distance itself from van Eyk. Following those noises, on 21 November Aurora tersely announced a meeting for unitholders to consider the replacement of Aurora as responsible entity.

http://www.asx.com.au/asxpdf/20131121/pdf/42l0lf8lc10sq0.pdf

Meanwhile, ASIC maintains its sphincter-like silence.

According to its 2013 cash flow statement, VBP received $2.6m in dividends and interest from its related party "assets", with entirely reasonable and sustainable management expenses of $5.6m. VBP then paid $16m in distributions, made possible by $19m net inflows from unitholder applications.

http://www.asx.com.au/asxpdf/20130930/pdf/42jqdtc9kmrnw7.pdf

According to its annual report, VBP had total assets of $275m in 2013, $68m of which mysteriously consisted of receivables from brokers for securities sold, with $168m in the unlisted van Eyk Blueprint Alternatives Plus fund. These "assets" conspicuously fail to generate cashflows, which does not deter "investors" from buying VBP. The top 20 shareholders of VBP include funds such as van Eyk Blueprint Balance, van Eyk Blueprint High Growth and van Eyk Blueprint Capital Stable. This is open fraud, only possible because of ASIC's ongoing gross negligence and incompetence.

Aurora funds management is the responsible entity for VBP, acting as van Eyk's accomplice in this circular investment scam, but has lately started to distance itself from van Eyk. Following those noises, on 21 November Aurora tersely announced a meeting for unitholders to consider the replacement of Aurora as responsible entity.

http://www.asx.com.au/asxpdf/20131121/pdf/42l0lf8lc10sq0.pdf

Meanwhile, ASIC maintains its sphincter-like silence.

Wednesday 20 November 2013

CDM comes bearing "bonus options"

The success of a listed investment company is predicated on its success at issuing shares. Operating performance is utterly irrelevant and can be misrepresented at will. ASIC doesn't even bother maintaining a semblance of regulation of NTA disclosures, allowing funds to materially overstate assets and commit revaluation fraud with related parties. Since share issuing and asset misrepresentation is the life-blood and raison d'être of fraudulent investment companies, they continually invent new ways to issue shares and misrepresent assets. Having already quadrupled shares outstanding in 2013, Cadence Capital (CDM.AX) announced it had "resolved" to issue "bonus options" to its granny investors in January 2014.

http://www.asx.com.au/asxpdf/20131114/pdf/42kvn7ngr1lcws.pdf

Any value the option will have to shareholders will be taken directly from the shareholders themselves. The bonus options are a "free" gift to shareholders, from shareholders, with zero net value for shareholders. Given administrative costs, the "bonus option" offer is objectively of net negative value to shareholders, a scheme only benefiting management hoping to issue shares, and a clear breach of fiduciary duty. In net tangible asset disclosure documents, CDM now fraudulently claim these "bonus options" have a value of $0.075-$0.11 to shareholders, hoping to fool granny investors that expect such disclosure documents to be regulated. CDM management has conjured $0.075-$0.11 per share out of thin air, using the magic of accounting fraud.

http://www.asx.com.au/asxpdf/20131118/pdf/42kxzmp1nzqxqs.pdf

This net tangible asset disclosure is blatantly and intentionally fraudulent, and lodging it was a criminal act. It is an indictment on ASIC that it does absolutely nothing when funds deliberately falsify the most basic metric of all.

http://www.asx.com.au/asxpdf/20131114/pdf/42kvn7ngr1lcws.pdf

Any value the option will have to shareholders will be taken directly from the shareholders themselves. The bonus options are a "free" gift to shareholders, from shareholders, with zero net value for shareholders. Given administrative costs, the "bonus option" offer is objectively of net negative value to shareholders, a scheme only benefiting management hoping to issue shares, and a clear breach of fiduciary duty. In net tangible asset disclosure documents, CDM now fraudulently claim these "bonus options" have a value of $0.075-$0.11 to shareholders, hoping to fool granny investors that expect such disclosure documents to be regulated. CDM management has conjured $0.075-$0.11 per share out of thin air, using the magic of accounting fraud.

http://www.asx.com.au/asxpdf/20131118/pdf/42kxzmp1nzqxqs.pdf

This net tangible asset disclosure is blatantly and intentionally fraudulent, and lodging it was a criminal act. It is an indictment on ASIC that it does absolutely nothing when funds deliberately falsify the most basic metric of all.

GFL, FSI and the crossholding buyback scam

Associated investment companies Global Masters Fund (GFL.AX) and Flagship Investments (FSI.AX) are part of a cartel engaged in revaluation fraud, in the form of the crossholding buyback scam. Like all investment companies, GFL and FSI pay exceedingly real fees to management based on unrealized profits, "profits" that in most cases are never subsequently realized. By using crossholdings and buybacks, related parties can artificially inflate assets, "profits" and fees.

A director's private company owns 56% of GFL and 28% of FSI. GFL has reported net assets of $10m, 28% of which was diverted to buy shares in FSI, distorting reported NTA and allowing directors to doubledip fees. After this "investment" by GFL, FSI ramped its illiquid share price with buybacks, creating illusory profits on GFLs holding. By funneling funds from GFL into FSI, in order to benefit themselves at the expense of small investors, the directors have breached their fiduciary duty. By deliberately misrepresenting their funds' assets and profits they have committed securities fraud.

FSI receives $1.5m dividends annually from its assets annually, with costs anywhere between 28% and 100% of cash inflow, mainly due to rapacious management fees. GFL has expenses in excess of revenues. The share prices of these companies have nevertheless been manipulated to par with NTA, far above fair value, with ASIC's blessing.

A director's private company owns 56% of GFL and 28% of FSI. GFL has reported net assets of $10m, 28% of which was diverted to buy shares in FSI, distorting reported NTA and allowing directors to doubledip fees. After this "investment" by GFL, FSI ramped its illiquid share price with buybacks, creating illusory profits on GFLs holding. By funneling funds from GFL into FSI, in order to benefit themselves at the expense of small investors, the directors have breached their fiduciary duty. By deliberately misrepresenting their funds' assets and profits they have committed securities fraud.

FSI receives $1.5m dividends annually from its assets annually, with costs anywhere between 28% and 100% of cash inflow, mainly due to rapacious management fees. GFL has expenses in excess of revenues. The share prices of these companies have nevertheless been manipulated to par with NTA, far above fair value, with ASIC's blessing.

Monday 18 November 2013

In remission: USH patiently waits

Directors of failed listed investment companies sometimes promise to "consider" giving back the funds they have gained control over and are taking fees out of. Unsurprisingly, such promises are never kept, as some great new "opportunity" always emerges, prompting the directors to instead raise even more capital. If the company fails so spectacularly that new sucker investors cannot be found, there are several options, the easiest of which is to just walk away from the smoldering wreck and start a new fund. Another option is to rename and recapitalize the company with accomplices, using fake transactions between the related parties to inflate the valuation of remaining assets, as in the case of Australasian Wealth Investments (AWK.AX). Sometimes failed investment companies are hibernated as the directors wait for the right time to resume share issuing. One such carbon-frozen company is U.S. Masters Holdings Limited (USH.AX).

USH is a dormant listed securities fraud incorporated in the British Virgin Islands. According to its latest NTA disclosure USH has net assets of $255,000, or $0.011 per share, largely held as cash. The last traded price for USH was $0.20, or 18 times current asset backing, and this is the price USH advertises as the current ASX "market" price on its website. USH has not traded on the ASX since 2012 and is currently bidless. In its 2013 annual report USH reports $25,000 in revenue and $729,000 in expenses, with cash decreasing by $607,000. Auditor Ernst & Young nevertheless unreservedly endorsed the annual report, with no going concern qualification. Because why not? It's not like they will be held to account by anyone.

USH is a dormant listed securities fraud incorporated in the British Virgin Islands. According to its latest NTA disclosure USH has net assets of $255,000, or $0.011 per share, largely held as cash. The last traded price for USH was $0.20, or 18 times current asset backing, and this is the price USH advertises as the current ASX "market" price on its website. USH has not traded on the ASX since 2012 and is currently bidless. In its 2013 annual report USH reports $25,000 in revenue and $729,000 in expenses, with cash decreasing by $607,000. Auditor Ernst & Young nevertheless unreservedly endorsed the annual report, with no going concern qualification. Because why not? It's not like they will be held to account by anyone.

Friday 15 November 2013

Freelancer: priced for perversion

Freelancer (FLN.AX) listed on the ASX today, after an IPO of less than 7% of the company, with 30m shares offered at $0.50. Directors hold 87% of the 436m shares outstanding, with the top 20 shareholders owning 96%. Of the $15m cash raised, $1.25m was paid to a director's company for "various domain names" and $1m was spent in offer costs. $2.5m was doled out in non-recourse loans for directors and employees to buy employee shares. FLN opened at $2.50, pricing the company at $1.1bn, for a forecast 2013 price earnings multiple of 2,300. After peaking at $2.60 in the obligatory initial ramp, FLN's "market" price then fell as much as 45% in intraday trading, before closing at a $1.60.

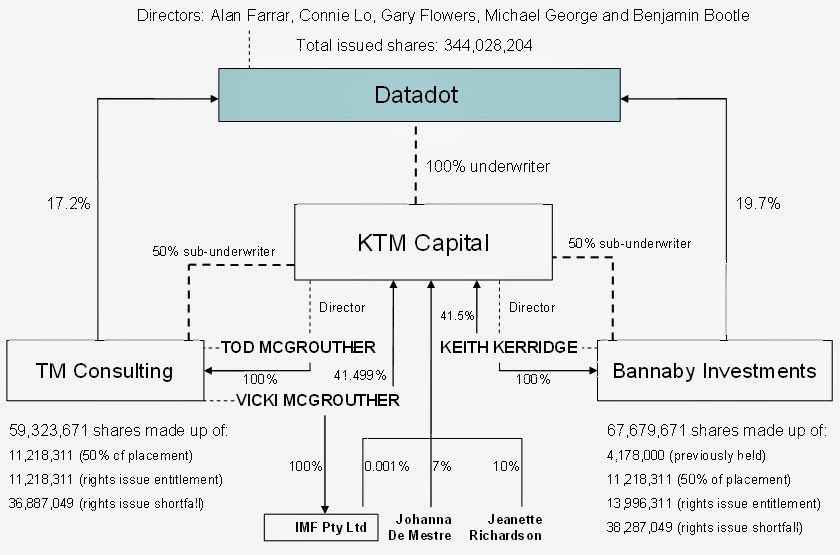

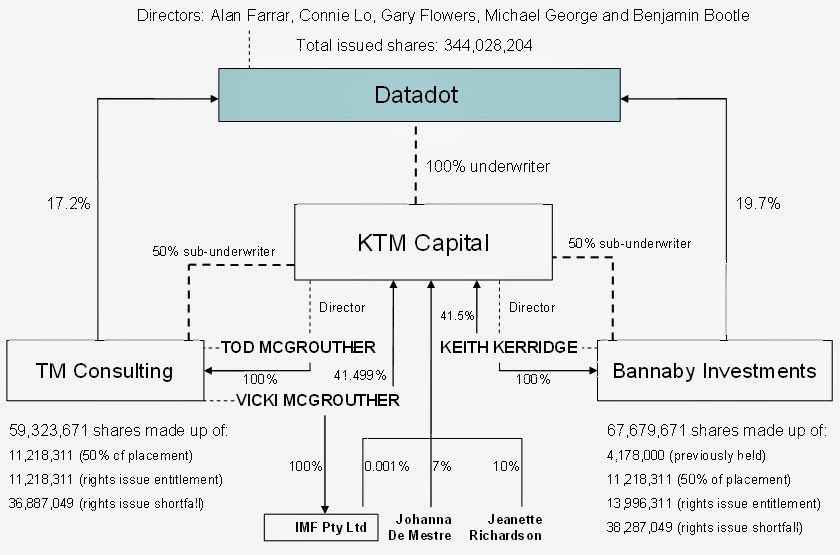

These facts would seem enough to deter any sane person from investing in FLN. But in today's bizarre world this market perversion is regarded not only as entirely normal, but as a very positive start to a great investment for long term buy-and-hold granny investors. The broker of the IPO was KTM Capital, who previously had managed capital raisings for poisoned chalices Datadot (DDT.AX) and Antaria (ANO.AX). The share prices of DDT and ANO naturally follow the by-now familiar pattern of long term shareholder value destruction interspersed with temporary ramps.

In the case of Datadot, KTM got a wrist-slap from the Takeovers Panel for a fraudulent scheme to benefit insiders, with its conduct declared unacceptable and misleading.

http://www.takeovers.gov.au/content/DisplayDoc.aspx?doc=reasons_for_decisions/2009/013.htm&doctype

http://www.takeovers.gov.au/content/DisplayDoc.aspx?doc=reasons_for_decisions/2009/013.htm&doctype

So do as the co-opted media tells you, don't dig too deeply researching or thinking, just throw caution to the wind and buy all these great shares that are being shilled.

These facts would seem enough to deter any sane person from investing in FLN. But in today's bizarre world this market perversion is regarded not only as entirely normal, but as a very positive start to a great investment for long term buy-and-hold granny investors. The broker of the IPO was KTM Capital, who previously had managed capital raisings for poisoned chalices Datadot (DDT.AX) and Antaria (ANO.AX). The share prices of DDT and ANO naturally follow the by-now familiar pattern of long term shareholder value destruction interspersed with temporary ramps.

In the case of Datadot, KTM got a wrist-slap from the Takeovers Panel for a fraudulent scheme to benefit insiders, with its conduct declared unacceptable and misleading.

http://www.takeovers.gov.au/content/DisplayDoc.aspx?doc=reasons_for_decisions/2009/013.htm&doctype

http://www.takeovers.gov.au/content/DisplayDoc.aspx?doc=reasons_for_decisions/2009/013.htm&doctypeSo do as the co-opted media tells you, don't dig too deeply researching or thinking, just throw caution to the wind and buy all these great shares that are being shilled.

Thursday 14 November 2013

CYA pays greenmail to WAM

Century Australia Investments (CYA.AX) announced a share buyback on 14 November, purportedly for "capital management" purposes. In reality, the buyback is greenmail to WAM, which built up a 21% holding in CYA and threatened to oust current management. CYA's porcine management announced the buyback to keep their snouts firmly in the fee trough. CYA's "market" price had been moved to par with NTA prior to the announcement, and fixed at $0.89.

In the preceding month WAM increased its CYA holding by close to a million shares, in preparation for demanding greenmail, so that it could sell back some of its CYA shares at the ramped price, and keep the rest of its holding valued at this artificial price. The communications between WAM and CYA regarding this scam is material information for their granny investors. When CYA's criminal management lied to its investors about the reason for the buyback, they committed securities fraud.

Listed investment companies are the Drosophila of financial fraud research, as they can be straightforwardly analyzed and valued. CYA holds listed assets with a current value of around $70m, or $0.89 per share. CYA collects interest and dividends of around $3m from these assets yearly, with around $0.8m in costs, or 27%. The fair value of CYA as a going concern is thus 73% of NTA, i.e. $0.65 per share, while its liquidation value is $0.89 per share. CYA promised years ago to liquidate the fund and return the money to investors, but never actually intended to, since that would stop the fee party.

The criminals running these companies know all this very well, but lie and dissemble, claiming that no matter the costs of an LIC, its ongoing fair value is at NTA or above. This is of course ridiculous, since quite obviously an LIC with lower costs would be worth more to an investor than an otherwise identical LIC with higher costs. CYA ridiculously claims costs of 1.1%, dividing expenses by outstanding assets, yielding a deliberately deceptive and useless metric favored by fund fraudsters. The entire business model of the LICs depends on such dissembling, as they could never function if they had to issue shares at fair value.

In the preceding month WAM increased its CYA holding by close to a million shares, in preparation for demanding greenmail, so that it could sell back some of its CYA shares at the ramped price, and keep the rest of its holding valued at this artificial price. The communications between WAM and CYA regarding this scam is material information for their granny investors. When CYA's criminal management lied to its investors about the reason for the buyback, they committed securities fraud.

Listed investment companies are the Drosophila of financial fraud research, as they can be straightforwardly analyzed and valued. CYA holds listed assets with a current value of around $70m, or $0.89 per share. CYA collects interest and dividends of around $3m from these assets yearly, with around $0.8m in costs, or 27%. The fair value of CYA as a going concern is thus 73% of NTA, i.e. $0.65 per share, while its liquidation value is $0.89 per share. CYA promised years ago to liquidate the fund and return the money to investors, but never actually intended to, since that would stop the fee party.

The criminals running these companies know all this very well, but lie and dissemble, claiming that no matter the costs of an LIC, its ongoing fair value is at NTA or above. This is of course ridiculous, since quite obviously an LIC with lower costs would be worth more to an investor than an otherwise identical LIC with higher costs. CYA ridiculously claims costs of 1.1%, dividing expenses by outstanding assets, yielding a deliberately deceptive and useless metric favored by fund fraudsters. The entire business model of the LICs depends on such dissembling, as they could never function if they had to issue shares at fair value.

Tuesday 12 November 2013

Aquaint and Mariner launch new listed securities fraud

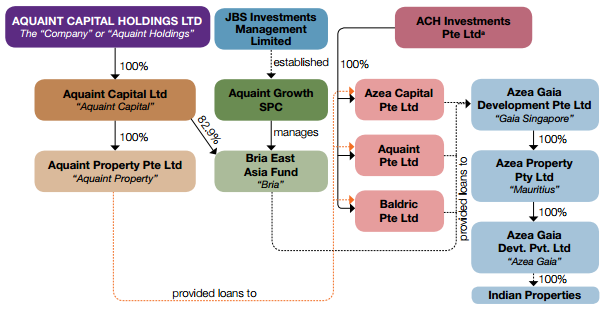

Newly ASX-listed Aquaint Capital (AQU.AX) is a Singaporean-Malaysian "property seminar" company involved in various loans to, investments in and revaluations of related parties. AQU raised $3m from offering 5m shares at $0.60, constituting 5% of shares on issue, with issue costs absorbing $1m of funds raised. Not a single share of AQU has traded on the ASX since its November 11 listing, yet now AQU can claim a "market" value of $62m, with ASIC's stamp of approval. With a standing bid for $0.65, AQU can actually claim a "market" value of $68m, legitimized and validated by Australian regulators. This stamp of approval is invaluable for seeking new sucker investors.

AQU has acquired an Australian financial services licence from a Mariner subsidiary, and several of the Mariner crew are now discreetly involved with Aquaint. Given Mariner's consistent record in almost complete destruction of investor funds, with MCX losing 99.9% of its value and counting, their discretion is perhaps understandable. Perhaps Aquaint can now perform some related party transactions with MCX's newly "revalued" retirement home business.

AQU's assets comprise of a maze of failing property loans and investments with related parties in several different countries, that it can value largely at will. AQU's prospectus reveals that even using its own "valuation techniques", many of its "investments" have a current value below the loans attached to them, and have not yielded promised returns. But AQU is not about generating any actual returns from its investments, it is in the business of revaluing related party assets upward and issuing shares, taking fees at every level.

Shown below is the structure of AQU's Indian properties, sold to its property seminar punters and now packaged into AQU shares. Although AQU owns 82.9% of Bria East Asia Fund, it claims to not control it.

AQU has acquired an Australian financial services licence from a Mariner subsidiary, and several of the Mariner crew are now discreetly involved with Aquaint. Given Mariner's consistent record in almost complete destruction of investor funds, with MCX losing 99.9% of its value and counting, their discretion is perhaps understandable. Perhaps Aquaint can now perform some related party transactions with MCX's newly "revalued" retirement home business.

AQU's assets comprise of a maze of failing property loans and investments with related parties in several different countries, that it can value largely at will. AQU's prospectus reveals that even using its own "valuation techniques", many of its "investments" have a current value below the loans attached to them, and have not yielded promised returns. But AQU is not about generating any actual returns from its investments, it is in the business of revaluing related party assets upward and issuing shares, taking fees at every level.

Shown below is the structure of AQU's Indian properties, sold to its property seminar punters and now packaged into AQU shares. Although AQU owns 82.9% of Bria East Asia Fund, it claims to not control it.

Monday 11 November 2013

Clean Seas Tuna goes fishing for granny investor cash

Failed fish farmer Clean Seas Tuna (CSS.AX) is issuing yet more shares, following an endless series of capital injections and consistently loss-making operations. In the days prior to the announcement of its latest October capital raising, which CSS purports to base on a "market" price, CSS sharply ramped its share price with the aid of accomplices. CSS naturally pulled the usual "aw chucks no idea" routine when queried by ASX, as it always does.

CSS is currently maintaining its price at $0.04 during the share offer, which entirely coincidentally would price the share raising at its maximum of $0.032. The capital raising squarely targets granny investors, offering a fraudulent 20% discount to the "market" price for investments up to $15,000. CSS will have 987,000,000 shares outstanding, and follows the standard pattern of long term decline interspersed with ramps. The corrupt directors of the CSS fiefdom also hire relatives and dish out extra "consulting" fees, as noblesse oblige.

CSS is currently maintaining its price at $0.04 during the share offer, which entirely coincidentally would price the share raising at its maximum of $0.032. The capital raising squarely targets granny investors, offering a fraudulent 20% discount to the "market" price for investments up to $15,000. CSS will have 987,000,000 shares outstanding, and follows the standard pattern of long term decline interspersed with ramps. The corrupt directors of the CSS fiefdom also hire relatives and dish out extra "consulting" fees, as noblesse oblige.

Sunday 10 November 2013

ASIC vouches that Goconnect is not ramped

Goconnect (GCN.AX) is a zany company with a billion shares outstanding and a consistent string of losses every year. Having formed a partnership with the Jackson family, GCN has abandoned any semblance of sanity. Its 2013 annual report humorously reports operating losses of $2m, net current liabilities of $4m, and $915 cash in the bank. GCN now plans to raise more money using the Jackson name, to build hotels and run reality shows in China.

http://www.asx.com.au/asxpdf/20131001/pdf/42jqzg949c22qq.pdf

GCN suddenly ramped its share price 250% in a few days in October, doing what it does best, namely issuing and ramping shares. GCN follows the familiar pattern of manipulated ASX companies, the interminable jolty downward ride. As always, ASIC pretends to notice none of this, and in effect fully supports GCN's and other companies' right to commit securities fraud, protecting the criminals by its refusal to take any action.

http://www.asx.com.au/asxpdf/20131001/pdf/42jqzg949c22qq.pdf

GCN suddenly ramped its share price 250% in a few days in October, doing what it does best, namely issuing and ramping shares. GCN follows the familiar pattern of manipulated ASX companies, the interminable jolty downward ride. As always, ASIC pretends to notice none of this, and in effect fully supports GCN's and other companies' right to commit securities fraud, protecting the criminals by its refusal to take any action.

Saturday 9 November 2013

Rey finds a "cornerstone investor"

Rey Resources (REY.AX) is one of the major holdings of AFA. On 29 October 2013, REY issued $71m shares at around $0.06 to new "cornerstone investor" Crystal Yield Investments, further increasing the proportion of shares controlled by top twenty shareholders. Before taking up this 19.9% block of shares, Crystal Yield transferred its existing 9.8% ownership in Rey to parent company Ricky Holdings, because reasons. To celebrate, the price was ramped to $0.125 in early November, allowing the "cornerstone investor" an immediate unrealized "profit" in excess of $4m on its "investment", and prompting ASX to send one its price query charade letters. REY's share price, volatile even by mining exploration company standards, follows the standard pattern of long term shareholder value destruction interspersed with temporary ramps to benefit insiders.

Friday 8 November 2013

Lion revalues related parties for a living

Lion Selection Group (LSX.AX) is an investment company that deliberately overstates its assets and issues shares to the public based on intentional misrepresentations. Its 2013 annual report claims $12m in listed investments and $33m in unlisted investments. Much of these funds are "invested" in related parties, allowing the criminals to double up their fees, with the assets freely "revalued" according to the fraudsters "opinions". LSX has revalued main unlisted investment One Asia from $0.40 to $0.75, and now carries its holding at $30m. Other related party investments include Asian Lion, African Lion 2 and African Lion 3.

http://www.asx.com.au/asxpdf/20131101/pdf/42kl426sh09k4g.pdf

To obscure and obfuscate, LSX continues to carry these related party "investments" as financial assets through profit and loss, denying it has the ability to control Asian Lion despite 63% ownership. Asian Lion, African Lion and Lion Selection Group are totally independent entities, you see. Completely unaligned.

http://www.asx.com.au/asxpdf/20131101/pdf/42kl426sh09k4g.pdf

To obscure and obfuscate, LSX continues to carry these related party "investments" as financial assets through profit and loss, denying it has the ability to control Asian Lion despite 63% ownership. Asian Lion, African Lion and Lion Selection Group are totally independent entities, you see. Completely unaligned.

Thursday 7 November 2013

CAQ finds "sophisticated investors"

Cell Aquaculture (CAQ.AX) is a failed fish breeder turned listed securities fraud. In a bizarre July 2013 recapitalisation, CAQ issued 250,000,000 shares at $0.01 to the public, and 100,000,000 shares at $0.005 to "sophisticated investors", bringing total number of issued shares to 374,000,000. At reinstatement of trading the magically transformed company traded at $0.02. Then in October CAQ started to be ramped, in what ASIC regards to be a perfectly normal market movement, going to $0.098 in early November.

CIN borrows from CIN to buy some CIN shares

Carlton Investments (CIN.AX) and Amalgamated Holdings (AHD.AX) have built up crossholdings approaching a billion dollars, separating ownership and control, allowing the companies to manipulate their own share prices and present deliberately falsified annual reports. CIN and associates hold 35% of AHD shares, while AHD and associates hold 61% of CIN shares. The combined crossholding has a nominal value of $868m, constituting 44% of CIN's and AHD's combined market cap. CIN and AHD also have substantial crossholdings with fellow criminal investment companies AFI, MLT, ARG and WAM.

http://www.asx.com.au/asxpdf/20130912/pdf/42jb3qsl6g9mr8.pdf

Buried in the notes of its 2013 annual report, with next to no detail provided, CIN discloses inter-company loans totalling $158m, up from $148m in 2012, that it eliminates upon consolidation. These $158m loans are apparently of zero interest to an investor wishing to build a fair view of the company. Some of the loans are taken out by Eneber, the controlled investment vehicle that owns much of CIN. So CIN has taken out a loan from itself, and used the proceeds to buy itself.

http://www.asx.com.au/asxpdf/20130912/pdf/42jb3qsl6g9mr8.pdf

Buried in the notes of its 2013 annual report, with next to no detail provided, CIN discloses inter-company loans totalling $158m, up from $148m in 2012, that it eliminates upon consolidation. These $158m loans are apparently of zero interest to an investor wishing to build a fair view of the company. Some of the loans are taken out by Eneber, the controlled investment vehicle that owns much of CIN. So CIN has taken out a loan from itself, and used the proceeds to buy itself.

Wednesday 6 November 2013

CVC Limited revalues itself upward

CVC Limited (CVC.AX) uses crossholdings, related party transactions, revaluations, "loans" and write-offs for the purpose of securities fraud. CVC ramps the companies it has significant interests in, creating artificial unrealized profits that never translate to cash flows. Directors of this scheme were recently arrested for tax fraud. Ripping off granny investors is fine, but don't dare deprive the taxman of his cut of the loot, or you might actually be arrested.

CVC's recently released annual report is a marvel of creativity, giving almost no indication of what the company actually does, instead showing a fudged profit driven by assorted revaluations ($21m), recoveries ($11m), impairments ($12m) and related party transactions. The company has $13m of loans to related parties that are periodically written off, and books $6.7m simply as "All other expenses". CVC reports $88m sales of goods, with no further details whatsoever provided.

http://www.asx.com.au/asxpdf/20131028/pdf/42kc7pv51x8pdh.pdf

CVC holds a number of listed and unlisted investments that it revalues at will. In its annual report, CVC notes that several of its listed investments are too illiquid for market prices to be useful for valuation, and then proceeds to use them anyway. CVC's portfolio of lossmaking companies include BNO.AX, VLW.AX, VSC.AX, LNR.AX, RES.AX, CYC.AX, MNZ.AX and BRU.AX. These have been ramped significantly since July 2013, which will allow CVC to claim further imaginary profits.

CVC's recently released annual report is a marvel of creativity, giving almost no indication of what the company actually does, instead showing a fudged profit driven by assorted revaluations ($21m), recoveries ($11m), impairments ($12m) and related party transactions. The company has $13m of loans to related parties that are periodically written off, and books $6.7m simply as "All other expenses". CVC reports $88m sales of goods, with no further details whatsoever provided.

http://www.asx.com.au/asxpdf/20131028/pdf/42kc7pv51x8pdh.pdf

CVC holds a number of listed and unlisted investments that it revalues at will. In its annual report, CVC notes that several of its listed investments are too illiquid for market prices to be useful for valuation, and then proceeds to use them anyway. CVC's portfolio of lossmaking companies include BNO.AX, VLW.AX, VSC.AX, LNR.AX, RES.AX, CYC.AX, MNZ.AX and BRU.AX. These have been ramped significantly since July 2013, which will allow CVC to claim further imaginary profits.

Tuesday 5 November 2013

Centuria funds "invest" in each other

Centuria Capital (CNI.AX) runs a crossholding scheme whereby a web of subsidiary funds hold stakes in each other, performing circular transactions deliberately creating falsified NTAs and results. The footnotes to the CNI annual report reveals dozens of festering CNI funds "investing in" and "lending to" each other.

CNI holds 2.1m units of the Centuria Direct Property Fund (CDPF), while subsidiaries Centuria Income Accumulation Fund (CIAF) holds 6.9m units and Centuria Growth Bond Fund (CGBF) holds 9.8m units. CGBF holds 1.7m units in Centuria 10 Spring St Fund (CSSF), 11.1m units in Centuria Diversified Property Fund (CDVPF), and 1.0m units in Centuria 8 Australia Avenue Fund (CAAF). Centuria Property Funds (CPF) holds 2.9m units in CSSF, Centuria Balanced Fund (CBF) holds 0.7m units in CSSF, Centuria High Growth Fund (CHGF) holds 0.7m units in CSSF, Australian Property and Mortgage Bond Fund (APMBF) holds 1.1m units in CSSF. CNI has "invested" $5.8m in CIAF, which in turn has "lent" $5.7m to Strategic Property Holdings (SPH) and $8.9m to Centuria 4-8 Woodville Street Fund (CWSF). CNI has a $1.0m receivable from CDVPF, $1.2m from CBGF1, and $0.3m from SPH. CPF has a $1.9m receivable from CSSF. CGBF bought 3.1m units in Centuria 131-139 Greenfell Street Fund (CGSF) at a "market" price from a related party.

http://www.asx.com.au/asxpdf/20131028/pdf/42kcsnx1fkxrfw.pdf

ASIC of course does absolutely nothing to stop crossholding and related party transaction fraud, provided the right forms have been filled in, but instead legitimizes and protects the criminals.

CNI holds 2.1m units of the Centuria Direct Property Fund (CDPF), while subsidiaries Centuria Income Accumulation Fund (CIAF) holds 6.9m units and Centuria Growth Bond Fund (CGBF) holds 9.8m units. CGBF holds 1.7m units in Centuria 10 Spring St Fund (CSSF), 11.1m units in Centuria Diversified Property Fund (CDVPF), and 1.0m units in Centuria 8 Australia Avenue Fund (CAAF). Centuria Property Funds (CPF) holds 2.9m units in CSSF, Centuria Balanced Fund (CBF) holds 0.7m units in CSSF, Centuria High Growth Fund (CHGF) holds 0.7m units in CSSF, Australian Property and Mortgage Bond Fund (APMBF) holds 1.1m units in CSSF. CNI has "invested" $5.8m in CIAF, which in turn has "lent" $5.7m to Strategic Property Holdings (SPH) and $8.9m to Centuria 4-8 Woodville Street Fund (CWSF). CNI has a $1.0m receivable from CDVPF, $1.2m from CBGF1, and $0.3m from SPH. CPF has a $1.9m receivable from CSSF. CGBF bought 3.1m units in Centuria 131-139 Greenfell Street Fund (CGSF) at a "market" price from a related party.

http://www.asx.com.au/asxpdf/20131028/pdf/42kcsnx1fkxrfw.pdf

ASIC of course does absolutely nothing to stop crossholding and related party transaction fraud, provided the right forms have been filled in, but instead legitimizes and protects the criminals.

Monday 4 November 2013

Mariner robs the ancients

Listed securities fraud Mariner Corporation (MCX.AX) now professes to be in the retirement home business. Having purchased an unfinished project from receivers for $6m of borrowed money in September, a month later MCX announced it had revalued the project at $13m, based on directors' "belief" and "independent valuation". Hey presto, an immediate imaginary $7m profit.

http://www.asx.com.au/asxpdf/20131025/pdf/42kbb9vhwh4rk2.pdf

On the 31st October, MCX was ramped 43%, closing at $0.15. In total 50,882 shares were traded on the ASX on that day, which is many times the average daily MCX volume, but still only corresponds to a few thousand dollars. According to the customary ASX price query charade, the ramp was a normal "market" movement, with this notion fully endorsed by ASIC.

http://www.asx.com.au/asxpdf/20131101/pdf/42kkxfrsmcdvg9.pdf

MCX has been ramped 700% since September on next to no volume. The ramp allows associated listed investment company Lemarne (LMC.AX) to book its recently granted holding in MCX at the artificial value, based on which it can issue shares to granny investors, all with ASIC's stamp of approval. Perhaps Sydney Morning Herald can then run a column shilling MCX and LMC, advising investors not to "dig too deeply" researching the scam, but to "throw caution to the wind" and "enjoy the ride".

http://www.asx.com.au/asxpdf/20131025/pdf/42kbb9vhwh4rk2.pdf

On the 31st October, MCX was ramped 43%, closing at $0.15. In total 50,882 shares were traded on the ASX on that day, which is many times the average daily MCX volume, but still only corresponds to a few thousand dollars. According to the customary ASX price query charade, the ramp was a normal "market" movement, with this notion fully endorsed by ASIC.

http://www.asx.com.au/asxpdf/20131101/pdf/42kkxfrsmcdvg9.pdf